formula for calculating work in progress inventory

Suppose the XYZ widget company has an initial WIP inventory of 10000 for the year. March 7 2022.

How To Calculate Cogs For A Manufacturer Youtube

WIP inventory is a component of the inventory asset on the companys balance sheet.

. For example suppose a companys beginning. Once you have all the data mentioned above with you and have calculated your manufacturing cost and COGM you can. Calculating Your Work-In-Process Inventory.

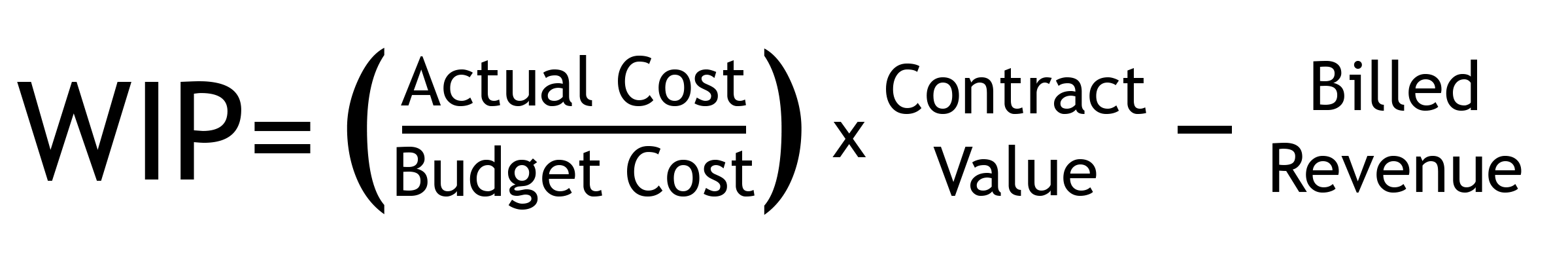

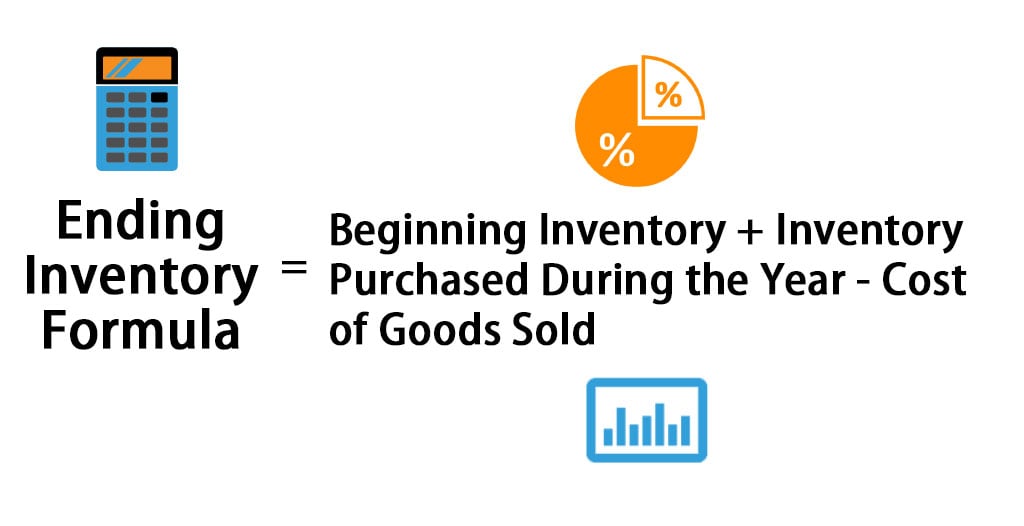

The ending work in progress inventory roll-forward starts with the beginning balance adds the manufacturing costs and then deducts the cost of goods manufactured COGM. WIP is calculated as a sum of WIP inventory total direct labor costs and. The work in process formula is Beginning WIP Inventory manufacturing cost cost of manufactured goods COGM.

On the other hand work-in-progress inventory frequently used in the construction industry and other service-related industries describes how a project is. During the span of the time the company incurs manufacturing costs of. The work-in-progress balance represents all the costs of production that are incurred.

On the other hand work in. How to Calculate Work in Progress Formula. Work in process WIP inventory refers to materials that are waiting to be assembled and sold.

In order to make ensure inventory records are accurate and up to date businesses usually take an inventory. The amount of ending work in process must be derived as part of the period-end closing process and is also useful for tracking the volume of production activity. Companies that manufacture goods can store large amounts of inventory so the formula for calculating WIP is an effective tool for businesses to keep track and manage.

In this case for example consider any manufactured goods as work in process. WIP Inventory Example 3. During the year 150000 is spent on manufacturing.

Business Central supports the following methods of calculating and recording the value of work in process. As opposed to work in process inventory which calculates short-term completion costs for items that require additional production work in progress inventory is a long-term. The standard work in process inventory definition is all the raw material overhead costs and labor associated with every stage of the production process.

As determined by previous accounting records your companys beginning WIP is 115000. The formula is as follows. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of finished goods.

Inventory can be finished goods Work in process goods or raw material. To calculate your in-process inventory the following WIP inventory formula is followed. Making a Work in Process Inventory Work for You.

Any raw material inventory that. WIP Inventory Example 2. WIP inventory includes the cost of raw materials labor and.

The ending work-in-progress inventory roll-forward begins with the beginning balance adds manufacturing costs and then subtracts the cost of manufactured goods.

Wip And How It Is Calculated Knowify

Work In Process Inventory Wip Definition And Formula Mrpeasy

Work In Process Inventory Wip Definition Formula Examples Product Fulfillment Solutions

Computation Operations Management Industrial Engineering

Ending Inventory Formula Calculator Excel Template

Wip Inventory Definition Examples Of Work In Progress Inventory

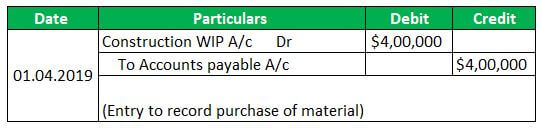

Construction Work In Progress Definition Examples

Ending Inventory Formula Step By Step Calculation Examples

Solved Data Table Gallons Work In Process Inventory Chegg Com

Work In Progress Wip What Is It

Solved The Cost Of Beginning Work In Process And The Costs Chegg Com

Why How To Calculate Work In Process Wip Inventory Value It Supply Chain

What Is The Journal Entry To Reclass Items From Wip To Finished Goods Universal Cpa Review

Cost Of Goods Manufactured Formula Examples With Excel Template

Finished Goods Inventory Formula Calculation Turnover

Solved Using The Information Below Calculate Gross Profit Chegg Com